(UPDATED 30 MARCH 2021)

I frequently get asked about setting fees for expert consultation and testimony. Particularly with nurses, I find that people are unsure of how to determine appropriate rates and are prone to undervaluing their worth. So I figured I’d write something up for those of you needing some guidance. These are absolutely my opinions, not hard and fast rules. When I looked to see what had been written on fees for experts there was very little out there relevant to nursing specifically, and where it involved criminal (vs. malpractice) trials, there was even less. We don’t talk about it much (people are squeamish about things involving money), and really, we should. So I’ll kick off the conversation…

To begin with: it’s okay to be reasonably compensated for your time and efforts. I’m not suggesting you never do anything for free (or for a really reduced rate)–I do plenty of that (see, for instance, this website). The key is doing the cost-benefit analysis (sometimes unpaid work leads to future paid work or other opportunities that make it worthwhile), and identifying your own parameters and limits for unpaid jobs.

Be cautious of people who want to reward you with exposure rather than dollars. I am happy to do some free work, if it is consistent with the mission of my firm and I have time in my calendar. But I weigh those offers carefully. I personally have been around long enough and have enough work that I don’t really need the exposure–but if you’re fresh out of the gate, those gigs can be a godsend. I did plenty of them early on.

Using what you make in your clinical role as a template for what you should charge as a consultant or expert witness is a faulty metric. However, it can be the starting point from which you then move up based on multiple factors. You must consider the fact that you will be taxed at a higher rate as a consultant (and you will be responsible for paying those taxes in April, since they won’t be automatically deducted); and if you are calculating a flat rate consider that many trial consultancies aren’t necessarily 9-5. During the last military trial I had our final day started at 7am and ended at 4:30am the following morning. With the exception of 2 brief meal breaks and the time waiting for the verdict and the sentence, I was essentially in the courtroom that entire time.

Some other things to fold into your calculations:

- Personal equipment you use (and the resulting wear and tear): laptops, cell phones, printers, scanners, etc.

- Overhead for doing the work: particularly costs for internet service provision and data plans

- Time spent on the minutiae of the business of consulting, like billing

- Post office box rental: I have a PO box for all correspondence and billing so that my home address isn’t being provided to the parties–it’s a more expensive box because I need to be able to receive FedEx packages, which many PO boxes don’t allow (I use a local UPS store and they receive my packages for me)

- Additional expenses: for example, I have a malpractice rider for consulting

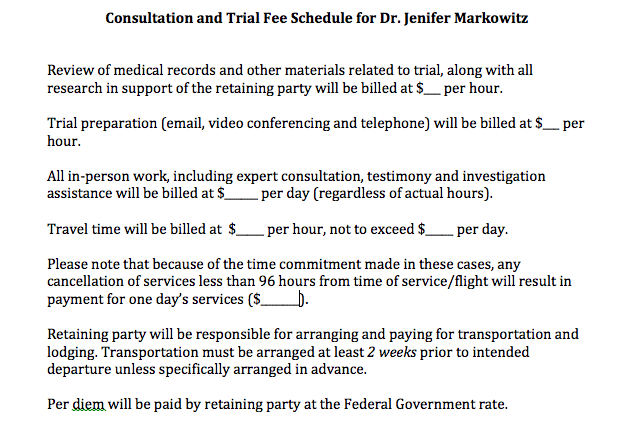

You need to create a fee schedule, not just come up with a single rate. I have rates for work I do from my home–those are billed hourly. If I have to travel somewhere, I bill at a flat daily rate for the work on site. My travel is billed at an hourly rate with a cap. And there is information in the fee schedule about expected reimbursement for travel, lodging and per diem. Remember that not everything costs the same: I charge a different amount for remote record review and phone consultation than I do for on-site consulting and trial work. Teaching is billed differently than trial. Travel days bill at a different rate, too. You want to tailor your fee schedule to the different services you provide.

So when an attorney asks for my fee schedule they get a PDF that looks something like this:

Your fees will ultimately be determined by several things–not just your degrees. My equation for setting a fee schedule is as follows: education + experience + certification + body of work. This means that education alone doesn’t determine how much you can charge. Factor all of these things into determining your worth. Not sure what the baseline should be? Talk to trusted colleagues who have established consulting practices for guidance. This will allow you to see the spectrum of compensation and provide a starting place for determining your own fee schedule.

Finally, I point you toward this statement from the American Academy of Pediatrics, published in their Guidelines for Expert Witness Testimony in Medical Malpractice Litigation. It provides an excellent framework for establishing your own fee schedule and moving forward thoughtfully in your role as expert consultant and witness:

The business practices (eg, marketing, contractual agreements, and payment for services) associated with the provision of expert witness testimony must be conducive to remaining nonpartisan and objective throughout the legal proceedings.

- Contractual agreements between physician expert witnesses and attorneys should be structured in a way that promotes fairness, accuracy, completeness, and objectivity.

- Compensation for expert witness testimony should be reasonable and commensurate with the time and effort involved.

- Physicians should not enter into contracts in which the fees for expert witness testimony are disproportionately high relative to the time and effort involved.

- Physicians should not enter into contracts in which the compensation for expert witness testimony is contingent on the outcome of the case.

(Pediatrics, Vol. 109 No. 5 May 1, 2002 p 979)

7 replies on “Creating a Fee Schedule for Expert Consultation and Testimony”

Great that you did this, Jen! I am sure that there are a LOT of people who need this information!

Jen, thank you sharing your expertise and this information. It could not have come at a more perfect time….just what I was searching for!!

Debbie–that’s wonderful! My favorite kind of feedback: “just what I needed”. I love it–thanks for reading.

Cardiovascular train is important to burn calories and scale back fats

across the stomach space.

how do i get a fee schedule for specialty doctrs

Ask them for it.

yes, thank you Jen-